It is increasingly challenging for companies to efficiently address fraud, corruption & ESG risks arising from third-party relationships while also applying regulatory compliance.

Our Due Diligence reports & investigations offer a complete overview on researched subjects worldwide, including both entities and individuals.

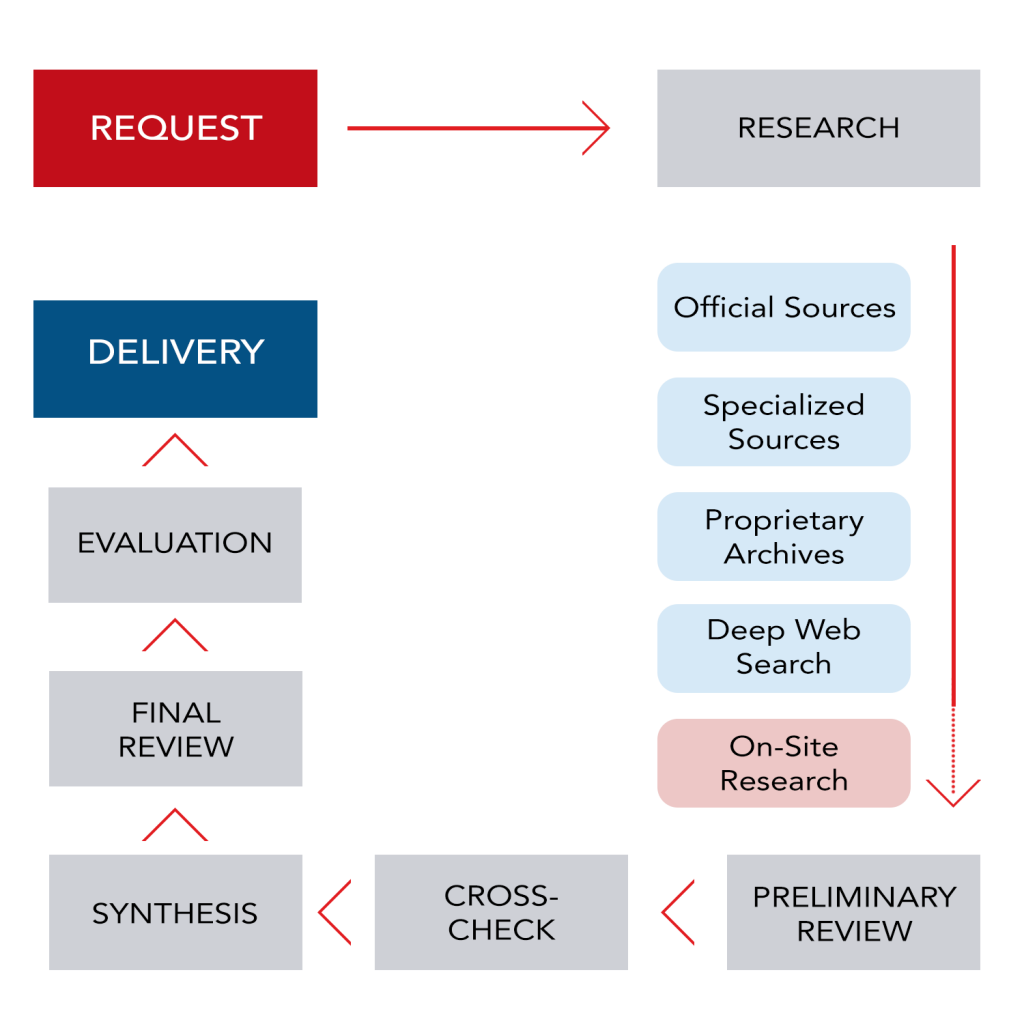

Following an in-house developed methodology, our specialists retrieve and thoroughly analyze data from thousands of sources at their disposal.

This way our Clients can quickly apprehend potential risks associated with the subject, as well as verify the authenticity of the information in their possession.

Our Clients look to us for conducting Due Diligence on:

- Existing / potential Clients

- Suppliers / Subcontractors / Distributors

- Potential Investors / Donors

- Current personnel & Potential hires

-

Merger and Acquisition and Joint Ventures Deals